Introducing the Opportunity: Can Individuals Released From Bankruptcy Acquire Credit Scores Cards?

Recognizing the Influence of Personal Bankruptcy

Upon declaring for insolvency, individuals are confronted with the significant effects that penetrate different facets of their economic lives. Personal bankruptcy can have a profound influence on one's credit rating, making it testing to accessibility credit history or loans in the future. This monetary discolor can stick around on credit rating reports for a number of years, affecting the individual's capacity to protect desirable rate of interest or financial chances. In addition, bankruptcy may result in the loss of properties, as certain ownerships may need to be liquidated to settle financial institutions. The psychological toll of personal bankruptcy ought to not be underestimated, as people may experience sensations of regret, pity, and anxiety due to their economic situation.

Additionally, bankruptcy can limit job opportunity, as some employers perform credit score checks as part of the hiring procedure. This can present a barrier to people seeking new task prospects or occupation advancements. In general, the impact of insolvency extends beyond financial restraints, affecting various aspects of a person's life.

Elements Impacting Charge Card Authorization

Obtaining a debt card post-bankruptcy rests upon numerous crucial factors that significantly affect the approval process. One vital factor is the candidate's credit rating. Adhering to personal bankruptcy, people typically have a reduced credit report score because of the adverse impact of the insolvency filing. Bank card business typically seek a credit score that shows the candidate's capacity to handle debt responsibly. Another vital consideration is the applicant's earnings. A steady revenue assures credit score card companies of the person's capacity to make timely repayments. In addition, the size of time given that the bankruptcy discharge plays an essential role. The longer the duration post-discharge, the more desirable the opportunities of approval, as it suggests financial stability and liable credit scores actions post-bankruptcy. Furthermore, the sort of charge card being used for and the issuer's particular needs can additionally affect authorization. By meticulously considering these aspects and taking actions to rebuild debt post-bankruptcy, individuals can improve their leads of getting a charge card and working towards monetary healing.

Steps to Rebuild Credit Scores After Bankruptcy

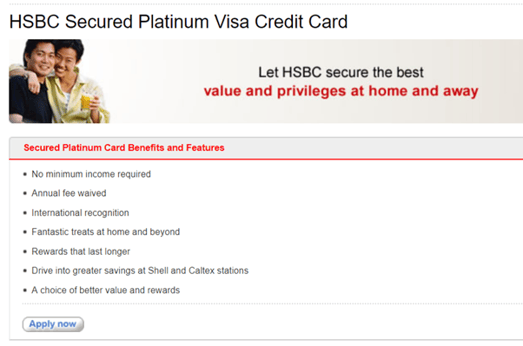

Reconstructing credit report after insolvency calls for a critical method concentrated on monetary discipline and regular financial debt monitoring. One effective approach is to obtain a guaranteed credit report card, where you deposit a particular amount as collateral to develop a credit limitation. In addition, think about coming to be an authorized individual on a family member's credit history card or checking out credit-builder finances to more boost your credit scores rating.

Safe Vs. Unsecured Credit Report Cards

Adhering to personal bankruptcy, people often consider the choice in between safeguarded and unprotected charge card as they aim to rebuild their creditworthiness and economic stability. Guaranteed bank card require a money down payment that acts as security, typically equivalent to the credit line granted. These cards are easier to acquire post-bankruptcy since the down payment lessens the risk for the company. Nevertheless, they might have higher fees and rates of interest contrasted to unsafe cards. On the other hand, unsecured charge redirected here card do not need a deposit original site but are more challenging to get approved for after bankruptcy. Providers analyze the applicant's credit reliability and may use lower fees and rate of interest for those with an excellent economic standing. When making a decision in between both, people must consider the advantages of simpler authorization with safe cards against the potential prices, and take into consideration unsecured cards for their long-lasting economic objectives, as they can aid rebuild credit report without locking up funds in a down payment. Ultimately, the choice between secured and unsecured charge card need to line up with the individual's financial objectives and capacity to manage debt responsibly.

Resources for Individuals Looking For Credit Scores Rebuilding

For people intending to improve their credit reliability post-bankruptcy, exploring readily available resources is vital to successfully browsing the credit restoring process. secured credit card singapore. One valuable resource for individuals seeking credit rating restoring is credit score therapy companies. These organizations supply monetary education, budgeting help, and individualized credit renovation strategies. By functioning with a credit history therapist, individuals can gain insights right into their credit rating records, find out methods to enhance their credit rating ratings, and get assistance on managing their finances efficiently.

One more practical source is credit scores tracking solutions. These services enable people to keep a close eye on their credit records, track any modifications or mistakes, and detect prospective signs of identification burglary. By checking their credit score routinely, people can proactively deal with any kind of concerns that may ensure and arise that their credit details depends on day and exact.

Furthermore, online devices and resources such as credit rating simulators, budgeting applications, and economic proficiency websites can provide people with useful details and devices to aid them in their credit history rebuilding journey. secured credit card singapore. By leveraging these sources effectively, individuals released from insolvency can take meaningful steps in the direction of improving their debt health and protecting a much better monetary future

Verdict

To conclude, people discharged from insolvency may have the opportunity why not check here to get bank card by taking actions to rebuild their debt. Variables such as credit report income, history, and debt-to-income proportion play a considerable duty in charge card approval. By recognizing the effect of bankruptcy, choosing in between secured and unsecured charge card, and making use of sources for credit score restoring, people can boost their creditworthiness and possibly obtain access to charge card.

By working with a credit rating counselor, individuals can acquire insights into their credit history reports, discover techniques to increase their credit rating ratings, and obtain assistance on handling their financial resources properly. - secured credit card singapore